In today’s fast-paced world, financial independence is more than just a dream—it’s an achievable goal with the right strategies and tools. As we enter 2024, the landscape of personal finance continues to evolve, offering new opportunities and challenges for those on the path to financial freedom. This guide explores the top strategies and tools you can leverage to achieve financial independence in 2024, ensuring your journey is both effective and sustainable.

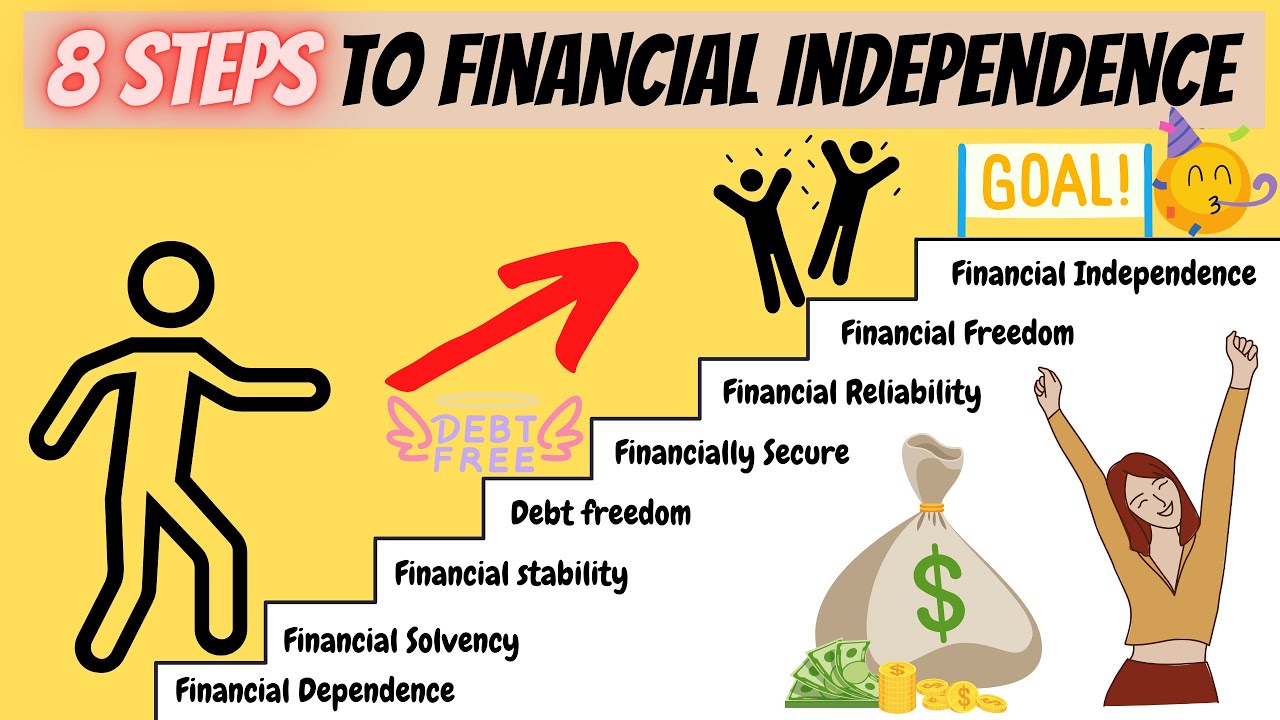

Understanding Financial Independence

Before diving into strategies and tools, it’s crucial to understand what financial independence means. Financial independence is the state of having enough income to cover your living expenses without relying on active employment. It often involves building multiple income streams, saving and investing wisely, and planning for long-term financial security.

1. Develop a Solid Financial Plan

A comprehensive financial plan is the cornerstone of achieving financial independence. Here’s how to build one:

- Set Clear Goals: Define what financial independence means to you. Whether it’s retiring early, traveling the world, or starting your own business, having clear goals will guide your planning and decision-making.

- Create a Budget: Track your income and expenses to understand where your money is going. Use budgeting tools or apps to manage your finances effectively and identify areas where you can cut costs.

- Build an Emergency Fund: Aim to save three to six months’ worth of living expenses in an easily accessible account. This fund will serve as a financial cushion in case of unexpected events.

- Pay Off Debt: Prioritize paying off high-interest debt, such as credit card balances. Reducing debt will free up more money for savings and investments.

2. Maximize Your Income

Increasing your income is a crucial step towards financial independence. Here are some strategies to consider:

- Invest in Your Skills: Enhance your earning potential by acquiring new skills or certifications. Higher qualifications can lead to better job opportunities and higher salaries.

- Explore Side Hustles: Consider freelance work, gig economy jobs, or starting a small business to supplement your primary income. Platforms like Upwork, Fiverr, and Etsy offer opportunities to monetize your skills and hobbies.

- Negotiate Your Salary: Don’t shy away from negotiating your salary or asking for a raise. Research industry standards and be prepared to present your case to your employer.

3. Invest Wisely

Investing is key to growing your wealth and achieving financial independence. Here are some investment strategies and tools to consider:

- Stock Market: Invest in stocks, mutual funds, or exchange-traded funds (ETFs) to build wealth over time. Consider using robo-advisors like Betterment or Wealthfront for automated investment management.

- Real Estate: Real estate investments can provide rental income and long-term appreciation. Platforms like Fundrise and RealtyMogul allow you to invest in real estate with lower capital requirements.

- Retirement Accounts: Contribute to retirement accounts such as a 401(k), IRA, or Roth IRA. These accounts offer tax advantages and can help you save for the future.

- Diversification: Diversify your investment portfolio to manage risk and maximize returns. Spread your investments across different asset classes, such as stocks, bonds, and real estate.

4. Utilize Technology and Tools

Technology has revolutionized personal finance, offering a range of tools to help you achieve financial independence. Here are some essential tools to consider:

- Budgeting Apps: Tools like Mint, YNAB (You Need A Budget), and PocketGuard can help you track your spending, set financial goals, and manage your budget more effectively.

- Investment Platforms: Platforms like Robinhood, Vanguard, and Charles Schwab offer user-friendly interfaces for managing your investments and tracking your portfolio’s performance.

- Debt Management Tools: Use tools like Credit Karma or Experian to monitor your credit score and manage your debt. These platforms can help you identify ways to improve your credit and reduce debt.

- Savings Apps: Apps like Digit and Qapital automatically save small amounts of money based on your spending habits, making it easier to build an emergency fund or save for specific goals.

5. Adopt a Long-Term Mindset

Achieving financial independence requires patience and a long-term perspective. Here are some tips to stay motivated and on track:

- Regularly Review Your Plan: Periodically review and adjust your financial plan to reflect changes in your goals, income, and expenses. This will help you stay aligned with your objectives and adapt to any financial shifts.

- Stay Educated: Continuously educate yourself about personal finance and investment strategies. Read books, take courses, and follow financial news to stay informed and make better financial decisions.

- Celebrate Milestones: Acknowledge and celebrate your achievements along the way. Whether it’s paying off a significant amount of debt or reaching a savings goal, recognizing your progress can boost motivation and keep you focused on your long-term objectives.

6. Seek Professional Advice

While self-management is crucial, seeking professional advice can provide additional insights and strategies tailored to your specific situation. Consider consulting with a financial advisor or planner to:

- Create a Customized Plan: A financial advisor can help you develop a personalized plan based on your unique goals, risk tolerance, and financial situation.

- Optimize Investments: Professionals can provide advice on investment strategies and help you make informed decisions about asset allocation and portfolio management.

- Plan for Taxes and Retirement: Advisors can assist with tax planning, retirement strategies, and estate planning, ensuring that you maximize your financial resources and minimize liabilities.

Conclusion

Achieving financial independence in 2024 is within reach with the right strategies and tools. By developing a solid financial plan, maximizing your income, investing wisely, utilizing technology, adopting a long-term mindset, and seeking professional advice, you can pave the way towards a financially secure and fulfilling future. Embrace these strategies, stay disciplined, and watch as your journey towards financial independence unfolds.