In an era of economic uncertainty and rapidly changing financial landscapes, millennials face unique challenges and opportunities in managing their finances. As 2024 unfolds, savvy budgeting and investing strategies are more crucial than ever for this generation, which is often balancing student loans, rising living costs, and a desire to build wealth for the future. This comprehensive guide offers practical and actionable budgeting tips tailored to millennials, ensuring they can navigate their financial journey with confidence and clarity.

Understanding the Millennial Financial Landscape

Before diving into specific strategies, it’s essential to grasp the current financial environment affecting millennials. As of 2024, key factors influencing millennial finances include:

- Student Loan Debt: Many millennials carry substantial student loan debt, which impacts their ability to save and invest.

- Housing Costs: The rising cost of housing, particularly in urban areas, places additional strain on millennial budgets.

- Inflation: Persistent inflation has increased the cost of living, making budgeting more challenging.

- Economic Uncertainty: Fluctuations in the job market and economic conditions create financial instability.

1. Create a Comprehensive Budget

A well-structured budget is the cornerstone of effective financial management. Here’s how millennials can create a budget that suits their lifestyle:

a. Track Your Income and Expenses: Use budgeting tools or apps to monitor your monthly income and expenses. Categorize spending to identify areas where you can cut back.

b. Set Clear Financial Goals: Establish short-term and long-term financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. This will help you stay focused and motivated.

c. Use the 50/30/20 Rule: Allocate 50% of your income to necessities (rent, groceries, utilities), 30% to discretionary spending (dining out, entertainment), and 20% to savings and debt repayment.

2. Build an Emergency Fund

An emergency fund is crucial for financial stability and peace of mind. Here’s how to build and maintain one:

a. Start Small: Aim to save at least $500 to $1,000 initially. Gradually increase this amount to cover three to six months of living expenses.

b. Set Up Automatic Transfers: Automate monthly transfers to your emergency fund to ensure consistent contributions.

c. Keep It Accessible: Store your emergency fund in a high-yield savings account or money market account for easy access and better returns.

3. Manage and Reduce Debt

Debt management is a significant concern for many millennials. Implement these strategies to tackle and reduce debt effectively:

a. Prioritize High-Interest Debt: Focus on paying off high-interest debts, such as credit card balances, first. This will save you money on interest over time.

b. Consolidate Debt: Consider consolidating multiple debts into a single loan with a lower interest rate. This can simplify payments and reduce overall interest costs.

c. Create a Debt Repayment Plan: Use methods like the snowball or avalanche approach to systematically pay off debts.

4. Save for Retirement Early

Starting retirement savings early can have a significant impact on long-term wealth accumulation. Here’s how millennials can get started:

a. Contribute to a 401(k) or IRA: Take advantage of employer-sponsored retirement plans or open an Individual Retirement Account (IRA). Aim to contribute at least 15% of your income, including any employer match.

b. Utilize Compound Interest: The earlier you start saving, the more you benefit from compound interest. Even small contributions can grow significantly over time.

c. Diversify Your Investments: Invest in a mix of stocks, bonds, and other assets to balance risk and return. Consider target-date funds for a diversified, hands-off approach.

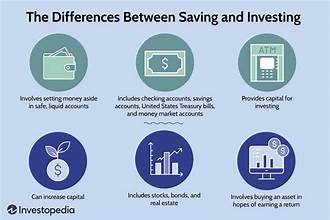

5. Invest Wisely

Investing is a powerful tool for building wealth. Millennials should consider the following investment strategies:

a. Understand Your Risk Tolerance: Assess your risk tolerance and invest accordingly. Younger investors can typically afford to take more risks for potentially higher returns.

b. Explore Low-Cost Index Funds: Index funds offer diversified exposure to the market with lower fees compared to actively managed funds.

c. Consider Robo-Advisors: Robo-advisors provide automated investment management with lower fees and can be a good option for beginners.

6. Embrace Frugality and Smart Spending

Frugality doesn’t mean sacrificing quality of life. Instead, it involves making smart spending choices:

a. Track Spending Habits: Use budgeting apps to monitor and categorize spending. Identify areas where you can cut back or find cheaper alternatives.

b. Shop Smart: Look for discounts, use cashback apps, and compare prices before making purchases.

c. Prioritize Needs Over Wants: Focus on essential expenses and save discretionary spending for occasional treats.

7. Leverage Technology for Financial Management

Technology can simplify financial management and enhance your budgeting efforts:

a. Use Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), or PocketGuard can help you track spending, set budgets, and manage finances.

b. Automate Savings and Investments: Set up automatic transfers to savings accounts or investment accounts to ensure consistent contributions.

c. Monitor Your Credit Score: Regularly check your credit score and report to ensure accuracy and address any issues promptly.

8. Seek Professional Financial Advice

While DIY budgeting and investing are valuable, professional guidance can offer personalized insights:

a. Consult a Financial Advisor: A certified financial advisor can help you create a tailored financial plan and offer advice on investments and retirement planning.

b. Explore Financial Literacy Resources: Take advantage of online courses, workshops, and books to enhance your financial knowledge.

9. Stay Informed and Adaptable

The financial landscape is constantly evolving, so staying informed and adaptable is crucial:

a. Follow Financial News: Stay updated on economic trends, investment opportunities, and changes in financial regulations.

b. Review and Adjust Your Budget: Regularly review your budget and financial goals to ensure they align with your current situation and adjust as needed.

c. Be Open to New Strategies: Embrace innovative financial strategies and tools that can enhance your budgeting and investing efforts.

Conclusion

For millennials navigating the financial landscape in 2024, adopting effective budgeting and investing strategies is essential for long-term success. By creating a comprehensive budget, building an emergency fund, managing debt, saving for retirement, investing wisely, and leveraging technology, millennials can achieve financial stability and growth. Embrace these tips to take control of your finances and pave the way for a secure and prosperous future.