In 2024, crafting a diversified investment portfolio is more crucial than ever. The financial landscape is evolving rapidly, influenced by technological advancements, shifting economic conditions, and global events. To navigate this dynamic environment and optimize returns while managing risk, investors must adopt strategic approaches to portfolio diversification. Here’s a guide to the top strategies for building a diversified portfolio this year.

1. Embrace Technological Innovations

a. Invest in Tech ETFs and Startups

The technology sector continues to drive innovation and growth. Investing in technology exchange-traded funds (ETFs) provides exposure to a broad range of tech companies, from established giants to emerging startups. Focus on ETFs that target high-growth areas such as artificial intelligence (AI), cloud computing, and cybersecurity. Additionally, consider allocating a portion of your portfolio to early-stage tech startups with promising potential.

b. Explore Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies are increasingly integrated into various industries. Diversifying into cryptocurrencies like Bitcoin and Ethereum, or investing in blockchain-related ETFs, can add a layer of diversification. However, due to their volatility, limit exposure to a manageable percentage of your portfolio.

2. Focus on Sustainable and ESG Investments

a. Integrate ESG Criteria

Environmental, Social, and Governance (ESG) investing is gaining momentum as investors seek to align their portfolios with ethical and sustainable practices. Invest in ESG-focused mutual funds or ETFs that prioritize companies with strong environmental and social practices. This approach not only supports sustainable development but also often correlates with long-term financial performance.

b. Green Bonds and Renewable Energy

Green bonds, issued to finance environmentally friendly projects, are an excellent way to support sustainable initiatives while earning interest. Additionally, invest in renewable energy sectors such as solar, wind, and hydropower. These sectors are poised for growth as the global transition to clean energy accelerates.

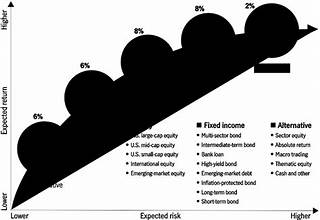

3. Diversify Across Asset Classes

a. Balance Traditional and Alternative Investments

A well-rounded portfolio includes a mix of traditional assets (stocks and bonds) and alternative investments. Alternative investments such as real estate, commodities, and private equity can offer additional growth opportunities and reduce correlation with traditional asset classes. Diversifying into real estate investment trusts (REITs) or commodities like gold can provide a hedge against market volatility.

b. Explore Fixed Income and Floating Rate Instruments

In a rising interest rate environment, incorporating floating rate bonds can help mitigate interest rate risk. These instruments adjust their interest payments based on prevailing rates, offering potential protection against bond price declines. Additionally, maintain a mix of short-term and long-term fixed income securities to balance yield and risk.

4. Geographic Diversification

a. Invest in Emerging Markets

Emerging markets present significant growth opportunities due to their expanding economies and increasing consumer bases. Diversify your portfolio by investing in international mutual funds or ETFs that focus on emerging markets. These investments can provide exposure to high-growth regions and reduce dependence on domestic market performance.

b. Consider Developed Markets

While emerging markets offer growth potential, developed markets provide stability and lower risk. Ensure your portfolio includes exposure to major developed economies such as the United States, Europe, and Japan. This balance helps mitigate risk and stabilizes overall returns.

5. Utilize Smart Beta and Factor Investing

a. Smart Beta Strategies

Smart beta investing combines elements of passive and active management by targeting specific factors such as value, momentum, and volatility. By incorporating smart beta strategies, investors can potentially achieve higher returns and reduce risk compared to traditional market-cap weighted indexes.

b. Factor-Based Funds

Factor-based funds focus on specific investment characteristics or factors that have historically driven returns. These factors include quality, low volatility, and size. Incorporating factor-based funds into your portfolio can enhance returns and provide diversification benefits.

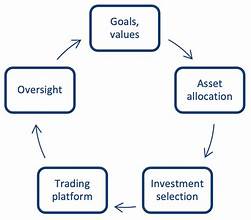

6. Regularly Rebalance Your Portfolio

a. Set Rebalancing Targets

Over time, the performance of different assets in your portfolio will vary, leading to deviations from your target allocation. Regular rebalancing ensures that your portfolio remains aligned with your investment goals and risk tolerance. Set periodic reviews (e.g., quarterly or annually) to adjust asset allocations as needed.

b. Monitor Market Conditions

Stay informed about market trends and economic conditions that may impact your portfolio. Adjust your asset allocation based on changing market dynamics and personal financial goals. Flexibility and ongoing assessment are key to maintaining a well-diversified and resilient portfolio.

Conclusion

Building a diversified portfolio in 2024 requires a strategic approach that embraces technological advancements, sustainability, and a broad mix of asset classes. By incorporating tech innovations, focusing on ESG investments, balancing traditional and alternative assets, diversifying geographically, and utilizing smart beta strategies, investors can optimize their portfolios for growth and risk management. Regular rebalancing and staying informed about market conditions will help ensure your portfolio remains aligned with your financial objectives. Implement these strategies to navigate the evolving investment landscape and achieve long-term success.