As we step into 2024, ensuring financial security in retirement is more critical than ever. With evolving economic conditions and changing retirement landscapes, it’s essential to adopt strategies that will help you maximize your retirement income. Here are the top five retirement income strategies for 2024 that can help you secure a stable and prosperous financial future.

1. Diversify Your Income Sources

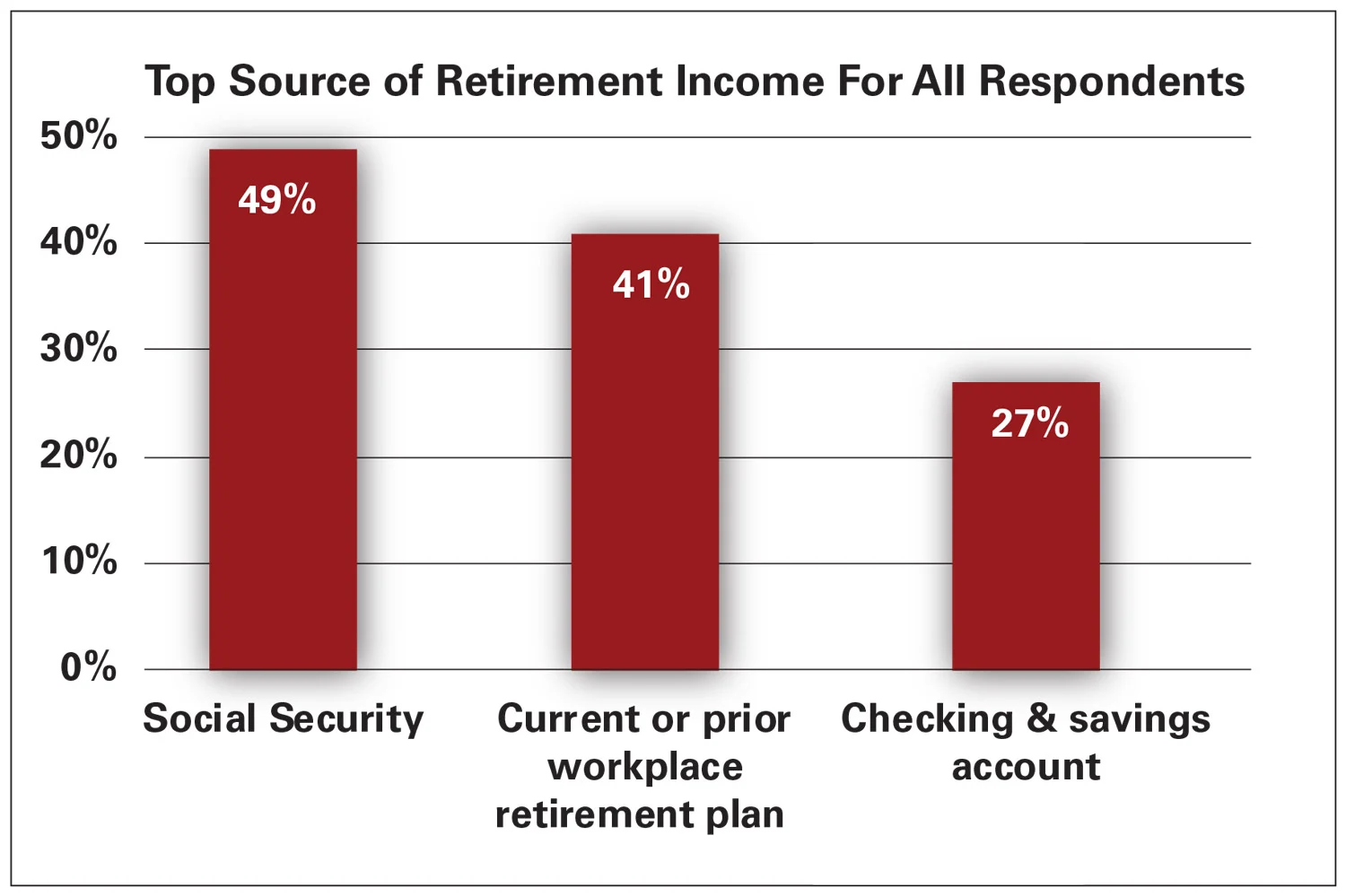

Diversification isn’t just for your investment portfolio; it’s also crucial for your retirement income strategy. Relying solely on Social Security or a single pension can leave you vulnerable to changes in policies or market fluctuations. Here’s how to diversify effectively:

- Social Security Benefits: Maximize your benefits by waiting until you reach full retirement age or even delaying until age 70 to increase your monthly payments.

- Pensions: If you have a pension, understand your options for lump-sum payments versus annuitization.

- Investment Income: Consider generating income from a mix of dividends, interest, and capital gains.

- Annuities: Fixed and variable annuities can provide predictable income streams and offer options for inflation protection.

By having multiple sources of income, you can reduce the risk of financial instability and improve your overall retirement security.

2. Utilize Tax-Efficient Withdrawal Strategies

The way you withdraw funds from your retirement accounts can significantly impact your tax bill. To maximize your income, consider the following tax-efficient strategies:

- Tax-Deferred Accounts: Withdraw from tax-deferred accounts like traditional IRAs and 401(k)s strategically to manage your taxable income and avoid pushing yourself into a higher tax bracket.

- Roth IRAs: Utilize Roth IRA withdrawals, which are tax-free, to supplement your income, especially in years when your taxable income is higher.

- Qualified vs. Non-Qualified Dividends: Understand the tax treatment of dividends and consider withdrawing funds from accounts that offer more favorable tax rates.

Effective tax planning can help you retain more of your income and reduce unnecessary tax liabilities.

3. Incorporate a Balanced Investment Approach

A well-balanced investment approach can enhance your retirement income and protect against market volatility. Here are some tips for achieving balance:

- Asset Allocation: Maintain a mix of stocks, bonds, and cash based on your risk tolerance and time horizon. A diversified portfolio can help smooth out market fluctuations.

- Income-Producing Investments: Focus on investments that provide regular income, such as dividend-paying stocks, municipal bonds, and real estate investment trusts (REITs).

- Rebalancing: Regularly review and adjust your portfolio to ensure it aligns with your risk tolerance and financial goals.

By adopting a balanced investment approach, you can generate a steady income while managing risk effectively.

4. Consider Health Care and Long-Term Care Insurance

Health care costs are a significant concern in retirement. To protect your financial security, consider the following:

- Health Insurance: Ensure you have adequate health insurance coverage, including Medicare and supplemental insurance plans, to cover medical expenses.

- Long-Term Care Insurance: Long-term care insurance can help cover costs associated with extended care services, such as nursing homes or in-home care, which are not typically covered by Medicare.

Planning for health care expenses can prevent unexpected financial strain and ensure you have the resources needed for potential medical needs.

5. Plan for Inflation and Cost of Living Adjustments

Inflation can erode the purchasing power of your retirement income over time. To safeguard against inflation:

- Inflation-Protected Securities: Consider investing in Treasury Inflation-Protected Securities (TIPS) or other inflation-linked investments.

- Cost of Living Adjustments: Look for income sources that include cost-of-living adjustments (COLAs) to keep pace with inflation, such as Social Security benefits or certain annuities.

- Regular Budget Reviews: Periodically review and adjust your budget to account for rising costs and ensure your income keeps up with your expenses.

By incorporating strategies to combat inflation, you can maintain your standard of living and preserve your financial security throughout retirement.

Conclusion

Maximizing your retirement income requires a multifaceted approach that incorporates diversification, tax efficiency, balanced investing, health care planning, and inflation protection. By adopting these strategies, you can enhance your financial security and enjoy a more comfortable and stable retirement.