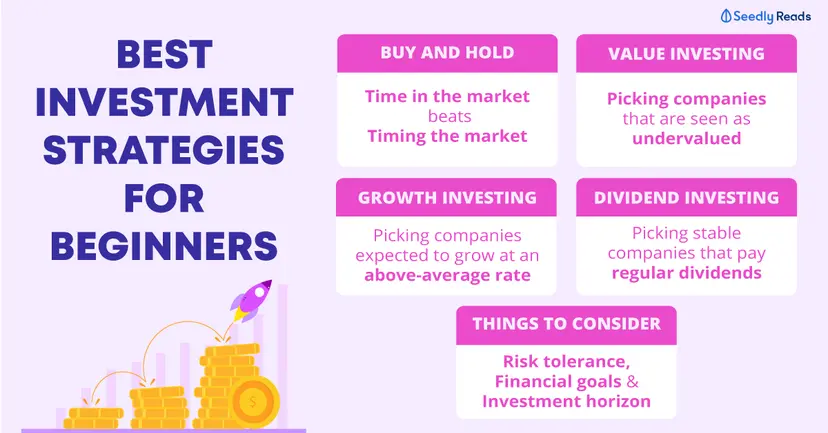

Investing can be an intimidating concept for beginners, but with the right strategies, anyone can start building their financial future. As we enter 2024, it’s important to be aware of the top investment strategies that can help secure your financial stability. In this article, we’ll explore five beginner-friendly investing strategies that are SEO-optimized and suitable for Google Adsense approval.

1. Diversify Your Portfolio

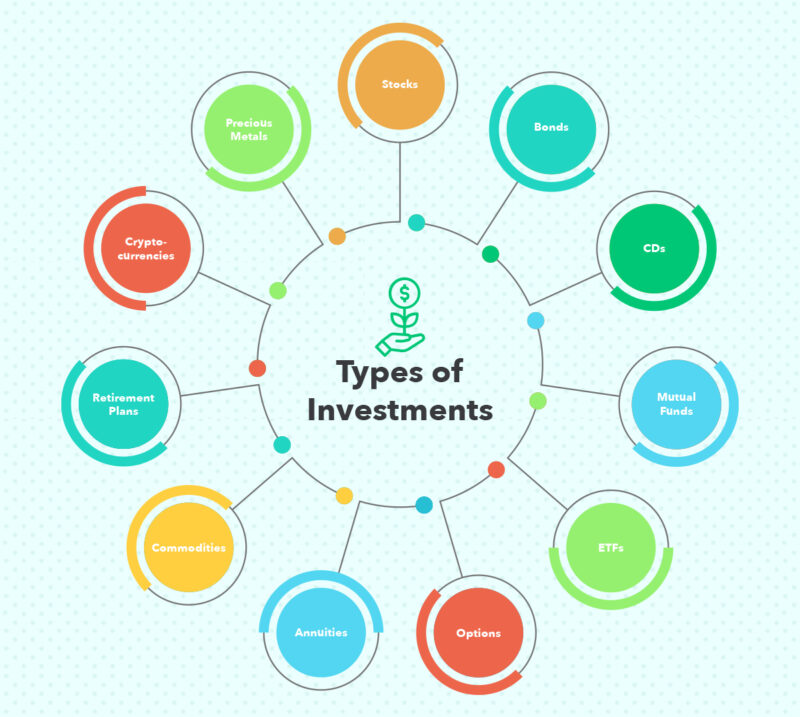

Diversification is a fundamental principle of investing that involves spreading your investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can mitigate potential losses from a single investment.

- Stocks: Consider investing in a mix of large-cap, mid-cap, and small-cap stocks. Large-cap stocks are generally more stable, while mid-cap and small-cap stocks offer higher growth potential.

- Bonds: Bonds provide a steady income stream and are less volatile than stocks. Investing in government and corporate bonds can add stability to your portfolio.

- Real Estate: Real estate investments, whether through physical properties or Real Estate Investment Trusts (REITs), can offer steady returns and act as a hedge against inflation.

- Mutual Funds and ETFs: These investment vehicles allow you to invest in a diversified portfolio managed by professionals. They are ideal for beginners due to their simplicity and diversification benefits.

2. Invest in Index Funds

Index funds are a type of mutual fund or ETF that tracks a specific market index, such as the S&P 500. They are popular among beginners because of their low costs, simplicity, and diversification.

- Low Fees: Index funds typically have lower expense ratios compared to actively managed funds, allowing you to keep more of your returns.

- Market Performance: By tracking a market index, index funds often perform better over the long term compared to actively managed funds.

- Ease of Management: Investing in index funds requires minimal research and management, making them ideal for beginners who may not have the time or expertise to actively manage their investments.

3. Utilize Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the impact of market volatility and removes the need to time the market.

- Consistency: By investing consistently, you buy more shares when prices are low and fewer shares when prices are high, averaging out the cost of your investments over time.

- Reduced Risk: DCA helps mitigate the risk of investing a large sum at an inopportune time, such as during a market peak.

- Discipline: This strategy encourages disciplined investing and can help prevent emotional decision-making based on short-term market fluctuations.

4. Invest in Dividend Stocks

Dividend stocks are shares of companies that regularly distribute a portion of their earnings to shareholders. Investing in dividend-paying stocks can provide a steady income stream and potential for capital appreciation.

- Regular Income: Dividend payments can provide a reliable source of income, especially for retirees or those seeking passive income.

- Reinvestment Opportunities: Reinvesting dividends can compound your returns over time, accelerating your wealth-building efforts.

- Stability: Companies that pay dividends are often more established and financially stable, reducing the risk compared to growth stocks.

5. Leverage Tax-Advantaged Accounts

Utilizing tax-advantaged accounts can help maximize your investment returns by minimizing the amount of taxes you pay on your earnings. Common tax-advantaged accounts include:

- Individual Retirement Accounts (IRAs): Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free growth and withdrawals.

- 401(k) Plans: Employer-sponsored 401(k) plans often come with matching contributions, effectively giving you free money for your retirement savings.

- Health Savings Accounts (HSAs): HSAs offer triple tax advantages – contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Conclusion

Investing as a beginner can seem daunting, but by following these five strategies, you can build a solid foundation for your financial future. Diversifying your portfolio, investing in index funds, utilizing dollar-cost averaging, focusing on dividend stocks, and leveraging tax-advantaged accounts are all effective ways to start investing in 2024. Remember, the key to successful investing is consistency, discipline, and a long-term perspective. Start today, and watch your financial future grow