The stock market is a dynamic and often unpredictable environment. As we approach 2024, investors must stay informed about the latest trends and strategies to navigate market volatility and maximize their returns. This comprehensive guide offers actionable tips and insights to help you make the most of the stock market in the coming year.

Understanding Market Volatility

Before diving into specific tips, it’s essential to grasp what market volatility means. Volatility refers to the fluctuations in stock prices over time. High volatility indicates significant price swings, while low volatility means more stable prices. In 2024, the market is expected to experience both, influenced by various factors such as economic conditions, geopolitical events, and technological advancements.

1. Stay Informed About Market Trends

Research and analysis are your best friends when it comes to navigating stock market volatility. Keep an eye on major economic indicators such as inflation rates, interest rates, and GDP growth. These factors can significantly impact market trends. Additionally, follow financial news and subscribe to reputable investment newsletters to stay updated on market developments.

Key Resources:

- Financial News Websites: Bloomberg, CNBC, Reuters

- Investment Newsletters: Morningstar, The Motley Fool

2. Diversify Your Portfolio

Diversification is a fundamental strategy to mitigate risk and improve potential returns. By spreading your investments across various asset classes (stocks, bonds, real estate, etc.), you can reduce the impact of a poor-performing asset on your overall portfolio.

Types of Diversification:

- Asset Class Diversification: Invest in a mix of stocks, bonds, and alternative assets.

- Geographical Diversification: Consider international stocks and bonds to hedge against regional economic downturns.

- Sector Diversification: Invest in different industry sectors to avoid overexposure to any single sector.

3. Focus on Quality Stocks

Investing in high-quality stocks is a prudent strategy, especially during volatile periods. Look for companies with strong financials, consistent earnings growth, and competitive advantages. Blue-chip stocks, which are shares of well-established companies with a history of stability and reliability, are often a safe bet.

Indicators of Quality Stocks:

- Strong Earnings Reports: Regular growth in revenue and profit margins.

- Solid Balance Sheets: Low debt levels and high cash reserves.

- Competitive Position: Market leaders with a robust business model.

4. Utilize Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the stock price. This approach helps reduce the impact of market volatility by spreading out your investments over time, which can lead to a lower average purchase price.

Benefits of DCA:

- Reduces Timing Risk: Lessens the impact of market timing errors.

- Simplicity: Automates your investment process.

- Emotional Control: Helps avoid impulsive investment decisions based on market fluctuations.

5. Keep an Eye on Interest Rates

Interest rates play a crucial role in stock market performance. When interest rates rise, borrowing costs increase for companies, which can impact their profitability and stock prices. Conversely, lower interest rates can stimulate economic growth and boost stock market performance.

Monitor Central Bank Policies:

- Federal Reserve (U.S.): Watch for changes in the federal funds rate.

- European Central Bank (ECB): Pay attention to monetary policy decisions affecting the Eurozone.

6. Implement Risk Management Strategies

Risk management is vital for protecting your investments and maintaining a balanced portfolio. Use techniques such as stop-loss orders to limit potential losses and take-profit orders to lock in gains. Additionally, regularly review and adjust your portfolio based on your risk tolerance and investment goals.

Risk Management Tools:

- Stop-Loss Orders: Automatically sell a stock if its price falls below a certain level.

- Take-Profit Orders: Sell a stock when its price reaches a predetermined level.

7. Consider Alternative Investments

Alternative investments can provide diversification and potentially higher returns compared to traditional stocks and bonds. Options include real estate, commodities, and cryptocurrencies. However, these investments often come with higher risks and require careful research and understanding.

Types of Alternative Investments:

- Real Estate: Investment properties or Real Estate Investment Trusts (REITs).

- Commodities: Gold, oil, and agricultural products.

- Cryptocurrencies: Bitcoin, Ethereum, and other digital assets.

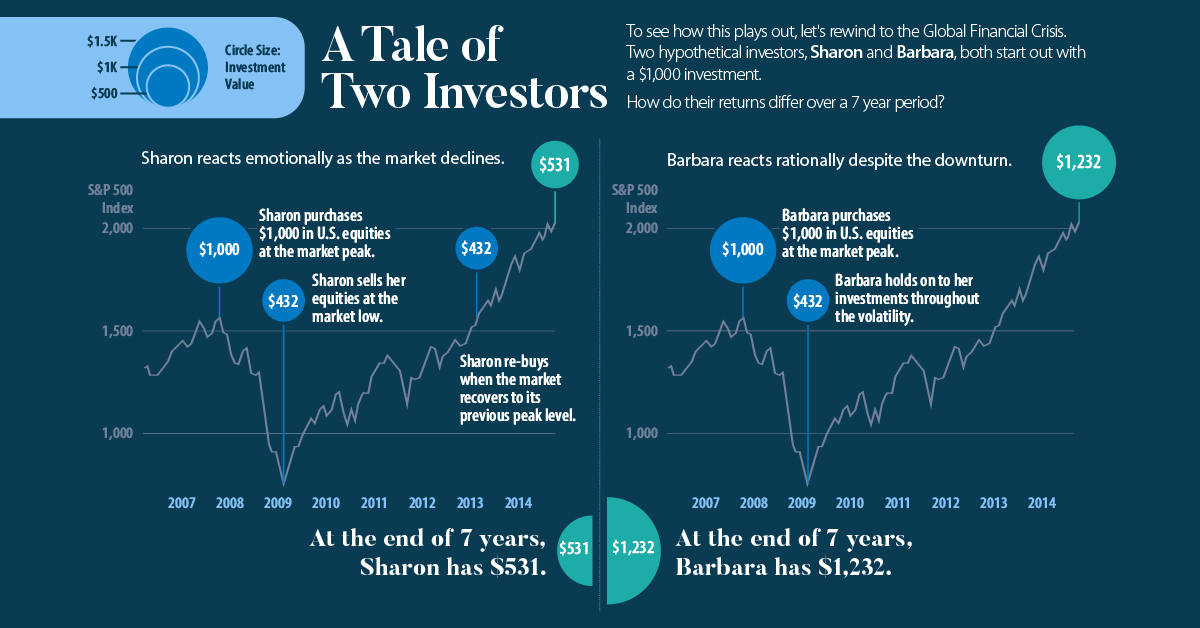

8. Stay Disciplined and Avoid Emotional Trading

Emotional trading can lead to impulsive decisions and potential losses. Develop a well-thought-out investment strategy and stick to it, even during periods of market turbulence. Avoid making decisions based on short-term market movements and focus on your long-term goals.

Tips for Staying Disciplined:

- Set Clear Goals: Define your investment objectives and time horizon.

- Develop a Plan: Create a detailed investment plan and follow it.

- Avoid Panic Selling: Resist the urge to sell investments based on fear or market noise.

9. Rebalance Your Portfolio Regularly

Over time, market fluctuations can cause your portfolio to deviate from your desired asset allocation. Regularly rebalancing your portfolio ensures that it remains aligned with your investment goals and risk tolerance. This process involves adjusting your holdings to maintain the intended balance of asset classes.

Rebalancing Strategies:

- Periodic Rebalancing: Review and adjust your portfolio at set intervals (e.g., quarterly, annually).

- Threshold Rebalancing: Rebalance when asset allocations deviate by a certain percentage from target levels.

10. Seek Professional Advice

If you’re unsure about navigating the stock market or developing a strategy, consider seeking advice from a financial advisor. A professional can provide personalized recommendations based on your financial situation, goals, and risk tolerance.

Choosing a Financial Advisor:

- Credentials: Look for certified professionals such as Certified Financial Planners (CFPs).

- Experience: Select advisors with a track record of success and expertise in your areas of interest.

- Fee Structure: Understand how the advisor is compensated (e.g., fee-only, commission-based).

Conclusion

Navigating the stock market in 2024 requires a combination of informed decision-making, strategic planning, and disciplined execution. By staying updated on market trends, diversifying your portfolio, focusing on quality stocks, and implementing effective risk management strategies, you can enhance your chances of maximizing returns and managing volatility. Remember to continuously review your investment approach and seek professional advice when needed. With these tips, you’ll be well-prepared to tackle the challenges and opportunities of the stock market in the coming year.