Achieving early retirement is a dream for many, but it requires careful planning, discipline, and strategic financial management. Whether you’re aiming to retire a decade before the traditional retirement age or simply seeking financial freedom sooner, understanding key strategies and insights can make your goal achievable. In this article, we’ll explore proven tips and essential financial planning strategies to help you retire early and enjoy a fulfilling life.

1. Define Your Retirement Goals

Before diving into the financial aspects, it’s crucial to define what early retirement means to you. Consider:

- Desired Retirement Age: When do you want to retire? Setting a specific age helps in creating a timeline.

- Lifestyle Expectations: What kind of lifestyle do you envision? Factor in travel, hobbies, or other interests.

- Location: Where do you plan to live? The cost of living varies greatly by location and can impact your retirement funds.

2. Create a Detailed Financial Plan

A solid financial plan is the backbone of early retirement. Here’s how to craft one:

- Calculate Your Retirement Needs: Estimate how much money you will need annually to cover your expenses. Consider inflation and unexpected costs.

- Determine Your Savings Goal: Use retirement calculators to figure out the total amount required. Factor in your current savings, expected growth, and additional contributions.

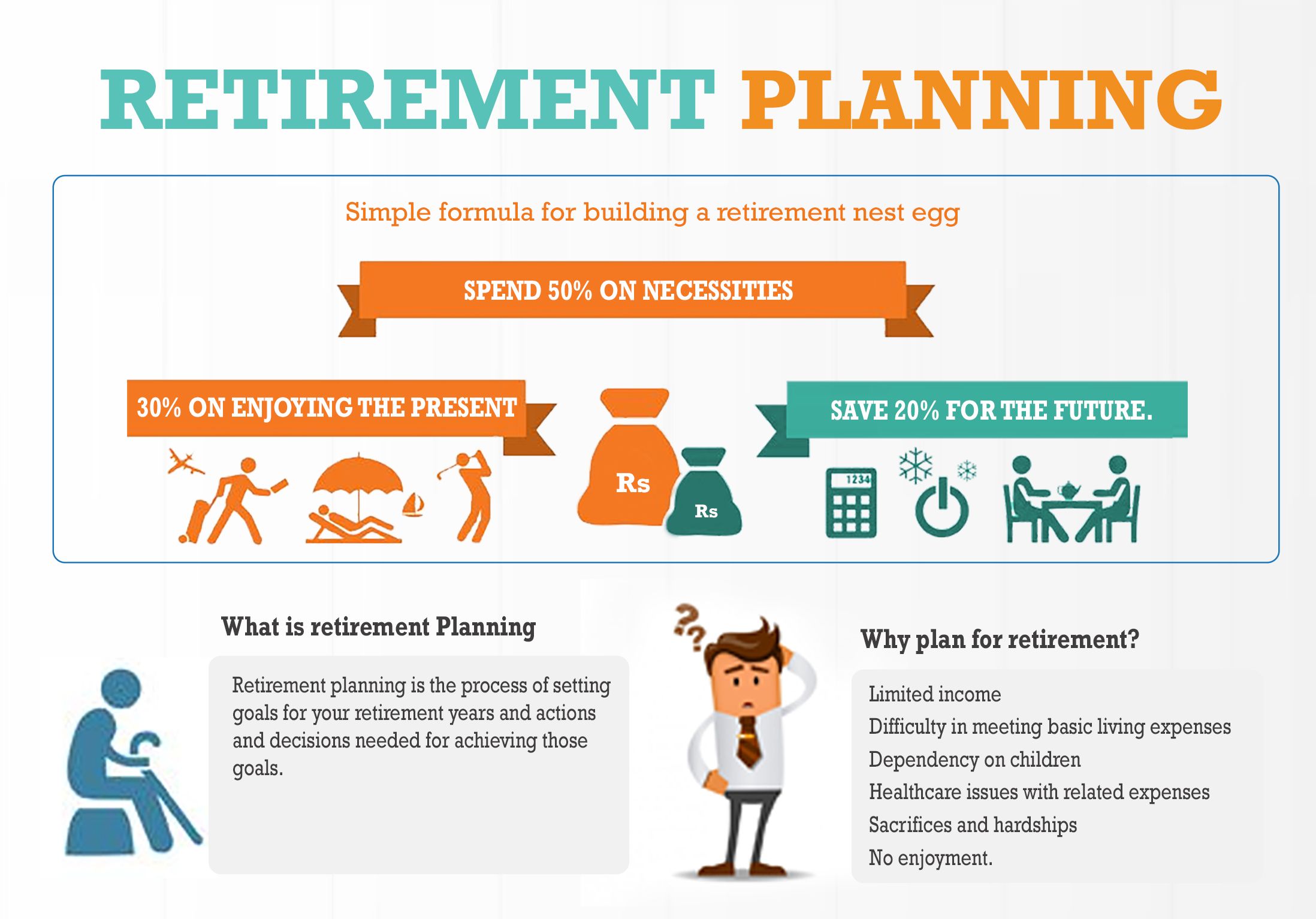

3. Build and Follow a Budget

Adhering to a budget is essential for accumulating wealth efficiently:

- Track Expenses: Keep a record of all expenditures to identify areas where you can cut costs.

- Prioritize Savings: Allocate a significant portion of your income to savings and investments.

- Avoid Unnecessary Debt: Minimize or eliminate high-interest debt to free up more money for savings.

4. Maximize Your Income

Increasing your income can accelerate your path to early retirement:

- Advance Your Career: Seek promotions, additional certifications, or higher-paying job opportunities.

- Side Hustles: Explore freelance work, consulting, or part-time jobs to boost your earnings.

- Passive Income: Invest in rental properties, dividend-paying stocks, or other income-generating assets.

5. Invest Wisely

Investing is a critical component of building wealth for early retirement:

- Diversify Your Portfolio: Spread your investments across various asset classes (stocks, bonds, real estate) to reduce risk.

- Focus on Growth Assets: Invest in assets with the potential for higher returns, such as stocks or mutual funds.

- Consider Tax-Advantaged Accounts: Utilize accounts like Roth IRAs or 401(k)s to maximize tax benefits.

6. Save Aggressively

To retire early, you need to save a substantial percentage of your income:

- Automate Savings: Set up automatic transfers to your retirement accounts to ensure consistent saving.

- Increase Savings Rate: Aim to save at least 20-30% of your income, or more if possible.

7. Monitor and Adjust Your Plan

Regularly review and adjust your financial plan to stay on track:

- Annual Reviews: Assess your progress towards retirement goals annually.

- Adjust for Changes: Update your plan based on changes in income, expenses, or life circumstances.

8. Plan for Healthcare Costs

Healthcare can be a significant expense in retirement. Consider the following:

- Health Savings Accounts (HSAs): Contribute to an HSA to save for medical expenses with tax advantages.

- Health Insurance: Plan for health insurance coverage until you’re eligible for Medicare.

9. Prepare for Emotional and Lifestyle Changes

Early retirement isn’t just about finances; it’s also about adjusting to a new lifestyle:

- Establish a Routine: Create a daily schedule that keeps you active and engaged.

- Pursue Passions: Use retirement to explore new hobbies, travel, or volunteer.

10. Seek Professional Advice

Consider consulting with a financial advisor for personalized guidance:

- Retirement Planning Experts: Work with professionals who specialize in early retirement planning.

- Tax Advisors: Get advice on optimizing tax strategies for your retirement savings.

Conclusion

Achieving early retirement is a rewarding yet challenging goal that demands meticulous planning and disciplined financial management. By setting clear goals, building a solid financial plan, maximizing income, and investing wisely, you can set yourself on the path to early retirement. Regularly review and adjust your strategies, plan for healthcare costs, and seek professional advice to navigate this journey successfully. With commitment and smart financial choices, early retirement can be within your reach.