Building an emergency fund is crucial for financial stability and peace of mind. An effective emergency fund provides a financial cushion for unexpected expenses and helps you avoid going into debt. As we navigate through 2024, understanding the best strategies for creating and maintaining an emergency fund can ensure you are well-prepared for unforeseen challenges. Here’s a comprehensive guide on how to build an effective emergency fund.

1. Set Clear Goals

Before you start saving, it’s essential to determine how much money you’ll need in your emergency fund. A common recommendation is to aim for three to six months’ worth of living expenses. This amount should cover essentials such as rent or mortgage, utilities, groceries, transportation, and other necessary expenses.

How to Set Your Goal:

- Calculate Monthly Expenses: List all your monthly expenses and total them.

- Multiply by 3-6 Months: Multiply this total by three to six to find your target amount.

- Adjust for Personal Circumstances: Consider factors like job stability, health, and family needs to adjust the amount.

2. Create a Separate Savings Account

To keep your emergency fund distinct from your regular savings, open a separate savings account. This segregation prevents you from accidentally spending the funds and helps you track your progress more effectively.

Benefits of a Separate Account:

- Accessibility: Choose an account with easy access but limited features to discourage spending.

- Interest Rates: Look for accounts offering competitive interest rates to grow your savings faster.

- Automatic Transfers: Set up automatic transfers to ensure regular contributions to your emergency fund.

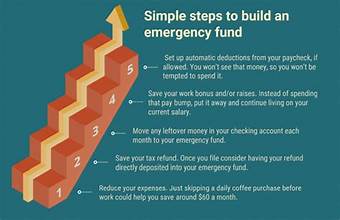

3. Build Your Emergency Fund Gradually

Saving a large sum can seem overwhelming, but breaking it down into manageable steps can make it more achievable. Set up a budget and allocate a portion of your monthly income to your emergency fund.

Steps to Build Gradually:

- Start Small: Begin with a modest amount and increase it over time.

- Review Your Budget: Identify areas where you can cut back to increase your savings.

- Stay Consistent: Regular contributions, no matter how small, will add up over time.

4. Prioritize Your Emergency Fund

Treat your emergency fund as a financial priority. Before making discretionary purchases or investing in non-essential items, ensure you are consistently contributing to your emergency fund. This mindset helps build financial discipline and ensures your fund remains a top priority.

Tips for Prioritizing:

- Use the 50/30/20 Rule: Allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

- Set Up Alerts: Monitor your account balance and set up notifications to stay on track.

- Avoid Using the Fund: Only use the fund for genuine emergencies to ensure it remains intact.

5. Automate Your Savings

Automating your savings is an effective way to ensure consistent contributions to your emergency fund. Set up automatic transfers from your checking account to your emergency savings account. This strategy reduces the temptation to spend the money and makes saving a regular habit.

How to Automate:

- Set Up Direct Deposits: Arrange for a portion of your paycheck to be directly deposited into your emergency fund.

- Use Bank Features: Most banks offer automatic transfer options through their online banking platforms.

- Adjust as Needed: Periodically review and adjust the transfer amount based on changes in your income or expenses.

6. Review and Adjust Your Fund Periodically

As your financial situation evolves, so should your emergency fund. Regularly review your fund to ensure it meets your current needs. Life changes, such as a new job, a move, or changes in expenses, can affect how much you should have in your emergency fund.

How to Review and Adjust:

- Quarterly Check-ins: Assess your fund balance and make adjustments if necessary.

- Update Your Goals: Recalculate your emergency fund target based on any major life changes.

- Increase Contributions: If possible, increase your savings rate as your financial situation improves.

7. Use Windfalls Wisely

Occasionally, you may receive unexpected money, such as a tax refund, bonus, or inheritance. Consider using a portion of these windfalls to boost your emergency fund. This can help you reach your goal faster and provide additional security.

Strategies for Using Windfalls:

- Allocate a Percentage: Decide in advance what percentage of windfalls will go into your emergency fund.

- Avoid Immediate Spending: Resist the temptation to use windfalls for discretionary purchases.

- Boost Your Savings: Use these funds to increase your emergency savings or reach your goal sooner.

8. Avoid Common Pitfalls

When building an emergency fund, be aware of common pitfalls that can hinder your progress. Avoid using your emergency fund for non-emergencies, neglecting regular contributions, or failing to adjust your fund as needed.

Common Pitfalls to Avoid:

- Using the Fund for Non-Emergencies: Reserve your emergency fund strictly for unexpected expenses.

- Skipping Contributions: Even small amounts add up, so try not to miss contributions.

- Ignoring Inflation: Adjust your fund target periodically to account for inflation and rising costs.

Conclusion

Building an effective emergency fund requires planning, discipline, and regular contributions. By setting clear goals, creating a separate savings account, automating your savings, and avoiding common pitfalls, you can ensure that your emergency fund provides the financial security you need. Remember to review and adjust your fund as your circumstances change, and use windfalls wisely to boost your savings. With these strategies, you’ll be well-prepared for any unexpected expenses that come your way in 2024 and beyond.