As retirement approaches, ensuring a stable and secure income stream becomes a top priority. Diversifying your retirement income sources can help mitigate risks and provide a more reliable financial future. Here’s how you can effectively diversify your retirement income streams with expert tips to ensure a secure and prosperous retirement.

1. Understand the Importance of Diversification

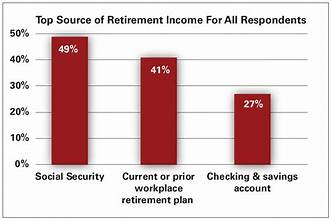

Diversification involves spreading your investments and income sources to reduce risk. Relying on a single source of retirement income, such as Social Security or a single pension, can be risky. By diversifying, you can protect yourself from fluctuations in one income source and enhance your overall financial stability.

2. Social Security Benefits

Social Security is a foundational income source for many retirees. To maximize this benefit:

- Delay Claiming: Consider delaying your claim until you reach full retirement age or even age 70 to receive higher monthly benefits.

- Work Longer: Increasing your work years can boost your benefit amount, as Social Security calculates benefits based on your highest 35 years of earnings.

3. Pensions and Annuities

If you’re fortunate enough to have a pension or are considering annuities:

- Pension Plans: These provide a predictable monthly income. Understand the terms of your pension plan and consider the impact of early retirement or changes in employment.

- Annuities: Fixed or variable annuities can offer guaranteed income for life or a set period. They can be useful for creating a steady income stream, but review fees and terms carefully.

4. Investments

Building a diversified investment portfolio can provide additional income. Consider:

- Dividend Stocks: Investing in dividend-paying stocks can provide a steady income stream while allowing for potential growth.

- Bonds: Bonds offer regular interest payments and are generally considered lower risk than stocks.

- Real Estate: Rental properties can generate consistent income and may appreciate over time. Be prepared for maintenance and management responsibilities.

5. Retirement Accounts

Utilize retirement accounts like IRAs and 401(k)s to their full potential:

- Traditional IRAs and 401(k)s: Contributions are often tax-deferred, and earnings grow tax-free until withdrawal. Plan withdrawals to minimize taxes and avoid penalties.

- Roth IRAs: Contributions are made with after-tax dollars, but withdrawals are tax-free in retirement. This can be beneficial for managing your tax liability.

6. Create a Retirement Budget

Developing a comprehensive budget helps in planning and managing your income streams:

- Estimate Expenses: Calculate your expected retirement expenses, including healthcare, housing, and leisure activities.

- Income Planning: Match your estimated expenses with your diversified income sources to ensure coverage and identify any gaps.

7. Healthcare and Long-Term Care

Plan for healthcare and potential long-term care expenses:

- Health Savings Accounts (HSAs): HSAs offer tax advantages and can be used for qualified medical expenses. Contribute to an HSA to build funds for healthcare costs.

- Long-Term Care Insurance: Consider purchasing long-term care insurance to cover potential future healthcare needs, which can protect your retirement savings.

8. Estate Planning

Effective estate planning ensures that your assets are distributed according to your wishes and can help reduce estate taxes:

- Wills and Trusts: Create or update your will and consider setting up trusts to manage your estate and protect your assets.

- Beneficiary Designations: Regularly review and update beneficiary designations on retirement accounts and insurance policies.

9. Consult a Financial Advisor

A financial advisor can provide personalized advice based on your specific situation:

- Investment Strategy: An advisor can help create a diversified investment strategy that aligns with your retirement goals.

- Tax Planning: Professional advice can aid in optimizing your tax situation and minimizing tax liabilities.

10. Regularly Review and Adjust

Retirement planning is not a one-time task. Regularly review and adjust your income sources and strategies:

- Monitor Performance: Keep track of your investments and income sources to ensure they continue to meet your needs.

- Adjust as Needed: Be prepared to make adjustments based on changes in your financial situation, market conditions, or life circumstances.

Conclusion

Diversifying your retirement income streams is crucial for ensuring a stable and secure financial future. By leveraging Social Security, pensions, investments, and other income sources, you can create a robust plan that adapts to your needs and reduces risks. Regularly reviewing and adjusting your strategy, along with consulting financial professionals, will help you maintain financial security throughout your retirement years.