Introduction

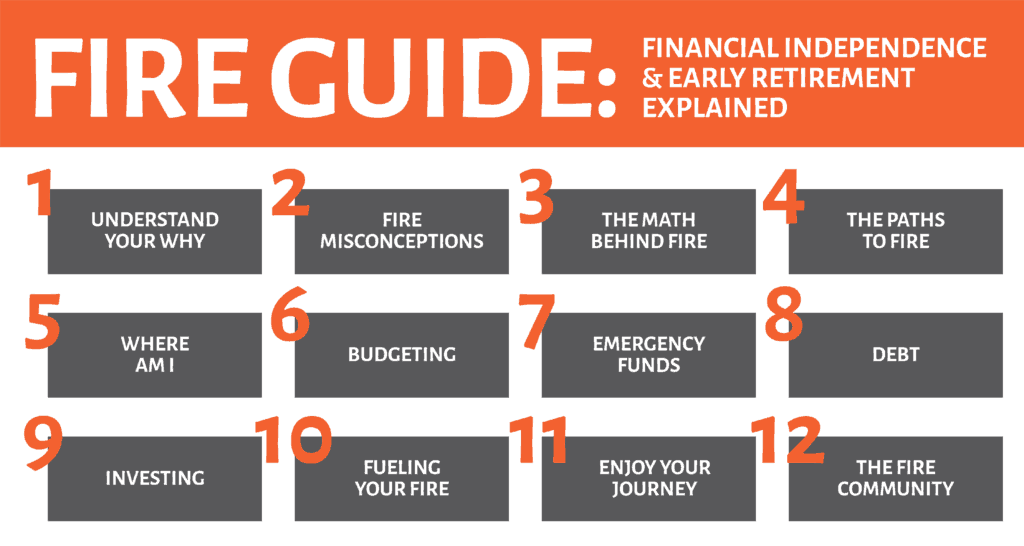

The FIRE (Financial Independence, Retire Early) movement has been gaining momentum over the past few years, and its influence continues to grow in 2024. This revolutionary approach to personal finance aims to help individuals achieve financial independence and retire far earlier than the traditional retirement age. As we delve into how the FIRE movement is shaping the landscape of personal finance in 2024, we will explore its core principles, the impact it has on financial planning, and practical steps to embark on this transformative journey.

Understanding the FIRE Movement

The FIRE movement is rooted in the idea of achieving financial independence through aggressive saving and investing, followed by retiring early. The concept first gained prominence through blogs and books, but its impact has now extended to mainstream media and financial planning circles. The movement promotes living below one’s means, investing wisely, and building passive income streams to achieve financial freedom.

Core Principles of the FIRE Movement

- Aggressive Saving and Investing

- High Savings Rate: The cornerstone of the FIRE movement is a high savings rate, often recommended at 50% to 70% of one’s income. This requires disciplined budgeting and cutting unnecessary expenses.

- Investment Strategies: Investing in assets that provide long-term growth, such as stocks, real estate, and low-cost index funds, is essential. Diversification and a well-thought-out investment plan are key components.

- Frugality and Minimalism

- Living Below Your Means: Embracing a frugal lifestyle helps in accumulating savings faster. This involves reducing discretionary spending and focusing on essential needs.

- Minimalism: Adopting minimalism can lead to significant savings. It encourages individuals to declutter their lives and focus on experiences rather than material possessions.

- Passive Income Streams

- Dividend Stocks: Investing in dividend-paying stocks can provide a steady stream of passive income.

- Real Estate: Rental properties can generate ongoing rental income, contributing to financial independence.

- Side Hustles: Engaging in side gigs or freelance work can supplement income and accelerate the journey to FIRE.

The Impact of the FIRE Movement in 2024

- Increased Awareness and Accessibility

- Mainstream Acceptance: The FIRE movement has transitioned from niche blogs to mainstream financial advice. Many financial advisors now incorporate FIRE principles into their recommendations.

- Educational Resources: Numerous online resources, books, and courses are available, making it easier for individuals to learn about and implement FIRE strategies.

- Technological Advancements

- Robo-Advisors: The rise of robo-advisors has made investing more accessible and affordable. Automated investment platforms can help individuals build a diversified portfolio with minimal effort.

- Personal Finance Apps: Apps that track spending, savings, and investments provide valuable insights and help individuals stay on track with their FIRE goals.

- Changing Attitudes Towards Work and Retirement

- Alternative Careers: The FIRE movement has influenced how people view work, with many opting for careers that align with their passions and values rather than traditional 9-to-5 jobs.

- Early Retirement Trends: Early retirement is becoming more common, with individuals leveraging their financial independence to pursue hobbies, travel, or start new ventures.

Practical Steps to Achieve FIRE in 2024

- Set Clear Financial Goals

- Define Your FIRE Number: Calculate the amount of money needed to retire comfortably based on your desired lifestyle and expenses. This figure is often referred to as the “FIRE number.”

- Create a Plan: Develop a detailed plan outlining how you will achieve your FIRE number, including savings targets, investment strategies, and income sources.

- Implement a Savings Strategy

- Automate Savings: Set up automatic transfers to savings and investment accounts to ensure consistency and avoid the temptation to spend.

- Cut Unnecessary Expenses: Review your budget and identify areas where you can reduce spending. Redirect these savings into investments.

- Invest Wisely

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk and maximize returns.

- Monitor and Adjust: Regularly review your investment portfolio and make adjustments as needed based on market conditions and your financial goals.

- Build Multiple Income Streams

- Invest in Dividend Stocks: Choose stocks that provide regular dividend payments to create a reliable income source.

- Consider Real Estate: Explore opportunities for rental properties or real estate investment trusts (REITs) to generate passive income.

- Stay Educated and Informed

- Keep Up with Financial Trends: Stay updated on financial news and trends to make informed investment decisions.

- Seek Professional Advice: Consult with financial advisors or experts to ensure your strategy aligns with your goals and risk tolerance.

Conclusion

The FIRE movement continues to revolutionize personal finance in 2024 by offering a roadmap to financial independence and early retirement. Through aggressive saving, smart investing, and the pursuit of passive income streams, individuals are transforming their financial futures and redefining traditional retirement concepts. By embracing the principles of the FIRE movement and implementing practical strategies, you can take control of your financial destiny and work towards achieving your own version of financial freedom. As the movement evolves, it will undoubtedly continue to inspire and guide those seeking a more fulfilling and financially secure future.