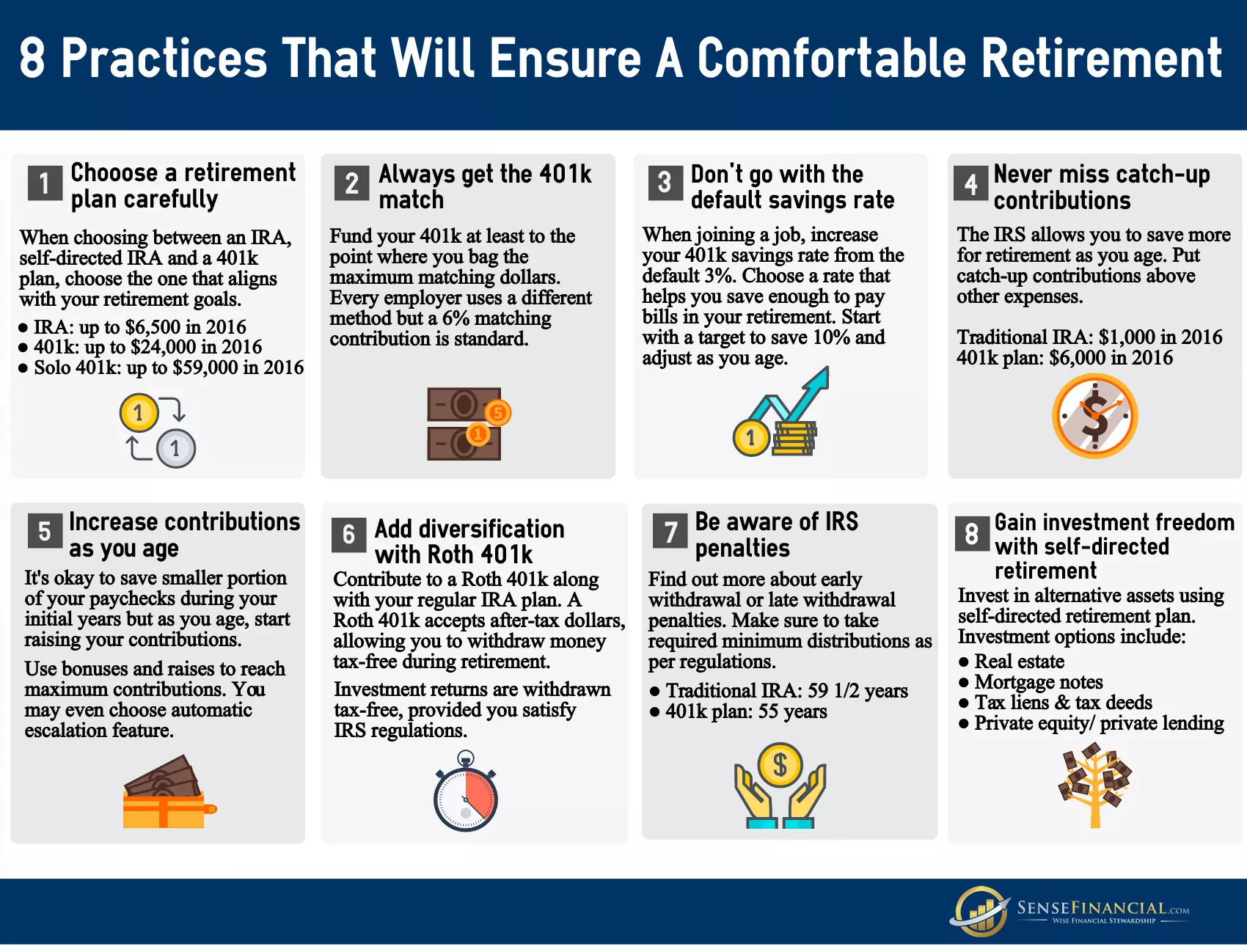

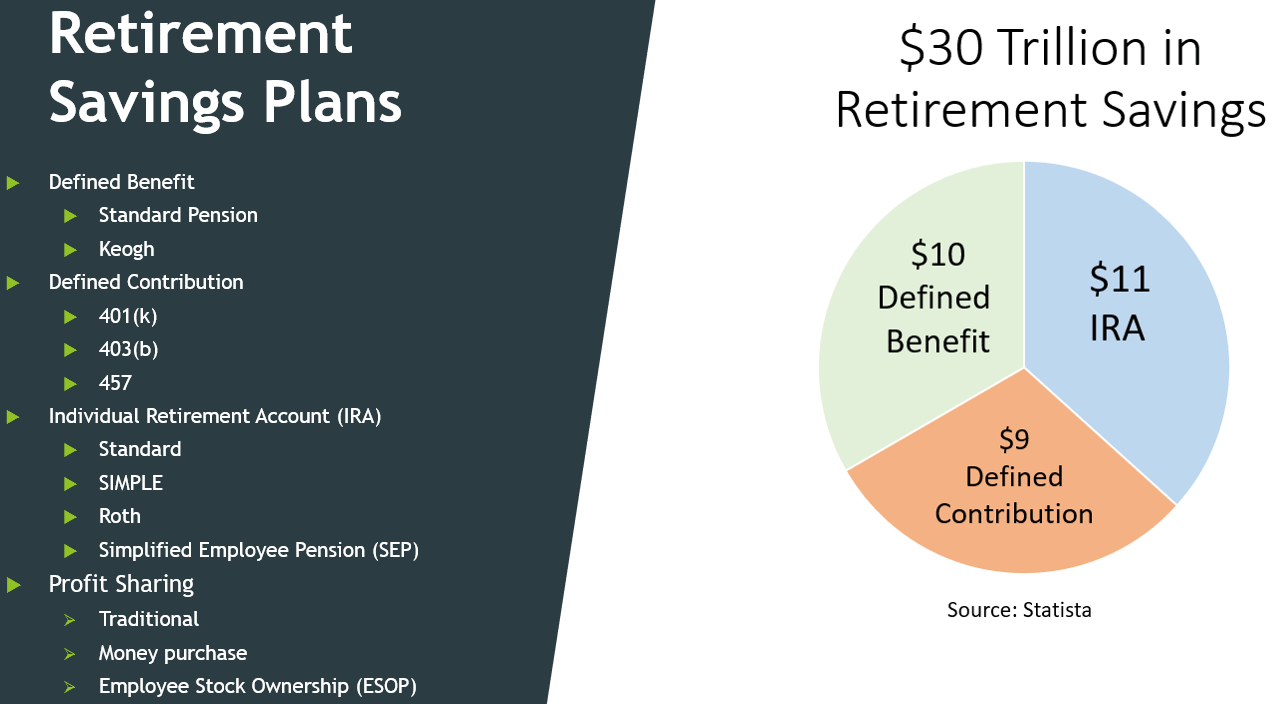

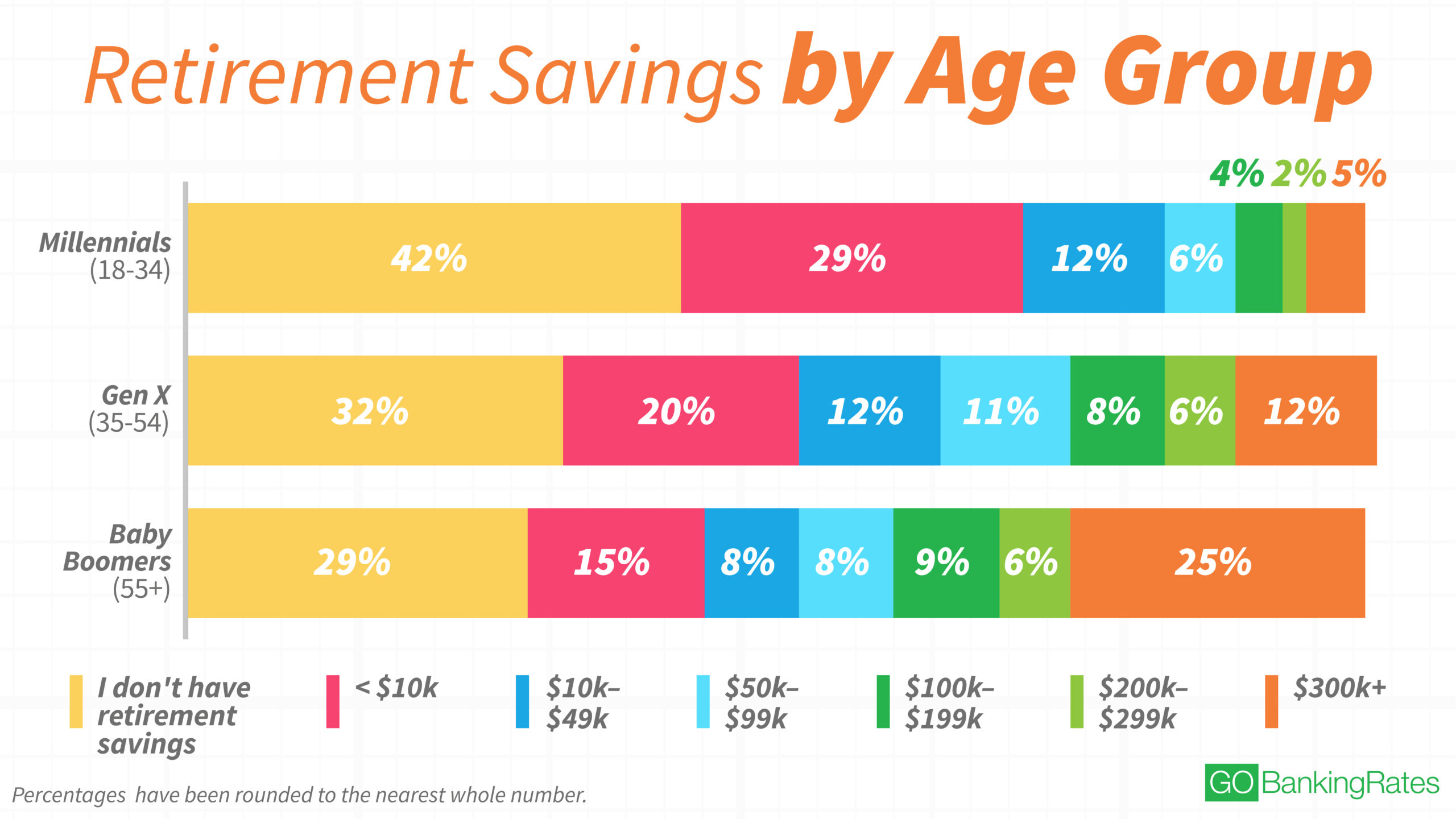

Planning for retirement is a crucial step in securing your financial future. With the plethora of retirement savings plans available, choosing the right one can be daunting. In 2024, several plans stand out for their benefits, flexibility, and potential for growth. Here, we’ll explore the top five retirement savings plans that can help you achieve a comfortable and secure retirement.

1. 401(k) Plans

Overview

The 401(k) plan remains a popular choice for retirement savings due to its employer-sponsored nature and tax advantages. Employees can contribute a portion of their salary before taxes, reducing their taxable income for the year.

Benefits

- Employer Matching: Many employers match a percentage of employee contributions, providing an immediate return on investment.

- Tax Advantages: Contributions are tax-deferred, meaning you won’t pay taxes until you withdraw funds in retirement.

- High Contribution Limits: In 2024, the contribution limit is $22,500, with an additional $7,500 catch-up contribution for those aged 50 and older.

Considerations

- Early Withdrawal Penalties: Withdrawing funds before age 59½ typically incurs a 10% penalty and taxes.

- Investment Choices: Limited to the options provided by the plan administrator.

2. Roth IRA

Overview

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met.

Benefits

- Tax-Free Growth: Contributions are made with after-tax dollars, so investments grow tax-free.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not require withdrawals at a certain age, allowing the money to grow indefinitely.

- Flexible Withdrawals: Contributions (but not earnings) can be withdrawn at any time without penalties or taxes.

Considerations

- Income Limits: Eligibility to contribute phases out at higher income levels (e.g., single filers earning over $153,000 in 2024).

- Contribution Limits: The annual contribution limit is $6,500, with a $1,000 catch-up for those 50 and older.

3. Traditional IRA

Overview

A Traditional IRA allows individuals to save for retirement with tax-deferred growth. Contributions may be tax-deductible depending on the individual’s income and participation in an employer-sponsored retirement plan.

Benefits

- Tax-Deductible Contributions: Contributions may lower your taxable income in the year they are made.

- Tax-Deferred Growth: Investments grow tax-deferred until withdrawals begin at retirement.

- Broad Investment Choices: More investment options compared to employer-sponsored plans.

Considerations

- RMDs: Required Minimum Distributions must begin at age 72.

- Early Withdrawal Penalties: Similar to 401(k) plans, early withdrawals are subject to a 10% penalty and taxes.

4. SEP IRA

Overview

A Simplified Employee Pension (SEP) IRA is designed for self-employed individuals and small business owners, offering a straightforward and tax-advantaged way to save for retirement.

Benefits

- High Contribution Limits: Contributions can be up to 25% of compensation or $66,000 in 2024, whichever is less.

- Tax-Deductible Contributions: Contributions are deductible for the business, lowering taxable income.

- Flexible Contributions: Employers can decide each year how much to contribute, providing flexibility based on business performance.

Considerations

- Employer Contributions Only: Only the employer can contribute, not the employees.

- Same Percentage: Employers must contribute the same percentage of salary for each eligible employee.

5. Solo 401(k)

Overview

A Solo 401(k), also known as an Individual 401(k), is ideal for self-employed individuals or business owners with no employees (other than a spouse).

Benefits

- High Contribution Limits: Combines employee deferrals (up to $22,500) and employer contributions (up to 25% of compensation) for a total of $66,000 in 2024.

- Catch-Up Contributions: An additional $7,500 catch-up contribution is available for those 50 and older.

- Loan Feature: Solo 401(k)s often allow loans up to 50% of the account balance, with a maximum of $50,000.

Considerations

- Administrative Responsibilities: More paperwork and administrative duties compared to other retirement accounts.

- No Employees Allowed: If you hire employees, the Solo 401(k) must be converted to a traditional 401(k) plan.

Conclusion

Choosing the right retirement savings plan is a critical step in ensuring a secure financial future. The 401(k), Roth IRA, Traditional IRA, SEP IRA, and Solo 401(k) each offer unique benefits tailored to different needs and circumstances. By understanding the features and advantages of each plan, you can make an informed decision that aligns with your retirement goals. Start planning today to secure your future and enjoy a comfortable retirement.