Retirement savings have always been a crucial aspect of financial planning, but recent changes in tax credits and laws are set to make these savings more accessible for everyone in 2024. These updates aim to provide individuals with more incentives to save for their retirement, ensuring a more secure financial future. This article delves into the specific changes and how they will benefit you.

Introduction

In 2024, several new tax credits and laws have been introduced to enhance the accessibility of retirement savings. These changes are designed to encourage more people to invest in their retirement funds, offering better financial stability and security for the future. By understanding these updates, you can take full advantage of the benefits and optimize your retirement planning.

New Tax Credits for Retirement Savings

1. Expanded Saver’s Credit

One of the most significant changes is the expansion of the Saver’s Credit. Previously, this credit was available to individuals with lower income levels, but in 2024, the income thresholds have been increased. This means that more people can qualify for this tax credit, reducing their tax liability and boosting their retirement savings.

2. Auto-Enrollment Credits

Employers who implement automatic enrollment for their employees’ retirement plans can now receive additional tax credits. This move aims to increase participation rates in retirement savings plans, ensuring that more workers are contributing regularly to their retirement funds. The credit helps offset the administrative costs for employers, making it a win-win situation for both employees and employers.

3. Catch-Up Contributions Credit

For those aged 50 and above, the catch-up contribution limits have been increased. Additionally, a new tax credit has been introduced to incentivize these contributions further. This change allows older individuals to save more as they approach retirement, providing a significant boost to their retirement funds.

Changes in Retirement Savings Laws

1. Increase in Contribution Limits

Starting in 2024, the contribution limits for various retirement accounts such as 401(k), IRA, and Roth IRA have been increased. This change allows individuals to save more money tax-deferred or tax-free, depending on the account type. Higher limits mean more substantial growth potential for retirement savings over time.

2. Improved Portability of Retirement Accounts

The new laws have made it easier to roll over retirement accounts when changing jobs. This improvement reduces the complexity and potential tax implications of transferring retirement savings from one employer’s plan to another. It ensures that individuals can maintain their retirement savings trajectory without interruption.

3. Enhanced Employer Matching

Employers are now encouraged to match employee contributions at higher rates. This change not only boosts the amount of money going into retirement accounts but also serves as a powerful incentive for employees to contribute more to their retirement savings plans. The new laws provide tax incentives to employers who offer these enhanced matching contributions.

Benefits of the New Tax Credits and Laws

1. Increased Retirement Savings

The primary benefit of these changes is the potential for increased retirement savings. Higher contribution limits, better employer matching, and expanded tax credits all contribute to more money being set aside for retirement. Over time, these factors can lead to a more comfortable and secure retirement.

2. Greater Financial Security

By making retirement savings more accessible and attractive, these changes help individuals build a more secure financial future. With more people participating in retirement savings plans and contributing higher amounts, the overall financial health of retirees is expected to improve.

3. Encouragement for Early Planning

The new tax credits and laws also serve as a strong motivation for individuals to start planning for retirement early. By taking advantage of the expanded Saver’s Credit and other incentives, even young workers can begin building their retirement nest egg from the outset of their careers.

How to Maximize the Benefits

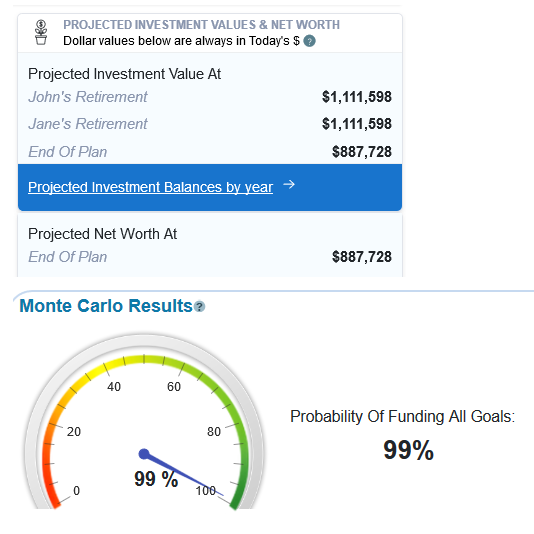

1. Review Your Current Retirement Plan

With the new changes in place, it’s essential to review your current retirement plan. Assess whether you are maximizing your contributions and taking full advantage of the available tax credits. Adjust your savings strategy to align with the increased contribution limits and new incentives.

2. Consult a Financial Advisor

Given the complexity of the new laws and tax credits, consulting a financial advisor can be highly beneficial. A professional can help you navigate the changes, optimize your retirement savings plan, and ensure you are making the most of the new benefits.

3. Stay Informed

Retirement planning is an ongoing process, and staying informed about the latest changes in tax laws and savings options is crucial. Regularly review updates from reliable sources and adjust your strategy as needed to take advantage of new opportunities.

Conclusion

The new tax credits and laws introduced in 2024 are set to make retirement savings more accessible and beneficial for everyone. By understanding these changes and adjusting your retirement plan accordingly, you can significantly enhance your financial security for the future. Start planning today to take full advantage of the new incentives and ensure a comfortable retirement.