Investing can seem daunting for beginners, but with the right guidance and a clear strategy, it can be a rewarding endeavor. This comprehensive guide aims to provide essential tips to help you navigate the complexities of today’s market and set you on the path to successful investing.

Understanding the Basics of Investing

Before diving into the market, it’s crucial to understand the basics:

What is Investing?

Investing involves committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. Common investments include stocks, bonds, mutual funds, real estate, and other securities.

Why Invest?

Investing helps you build wealth over time, provide for retirement, achieve financial goals, and outpace inflation. By investing wisely, you can ensure a more secure financial future.

Setting Clear Financial Goals

Setting clear, achievable financial goals is the first step to successful investing. Determine what you want to accomplish, whether it’s saving for retirement, buying a home, or generating passive income.

Short-Term vs. Long-Term Goals

Differentiate between short-term goals (buying a car, going on vacation) and long-term goals (retirement, children’s education). Your investment strategy will vary based on the timeline of your goals.

Building an Emergency Fund

Before investing, ensure you have an emergency fund. This should cover 3-6 months of living expenses, providing a financial cushion in case of unexpected events.

Educating Yourself

Investing requires a good understanding of the market and the various investment options available. Educate yourself through books, online courses, webinars, and financial news.

Key Resources for Beginners

- Books: “Rich Dad Poor Dad” by Robert Kiyosaki, “The Intelligent Investor” by Benjamin Graham.

- Online Courses: Websites like Coursera, Udemy, and Khan Academy offer courses on investing.

- Webinars and Podcasts: Platforms like YouTube and Spotify host numerous financial experts.

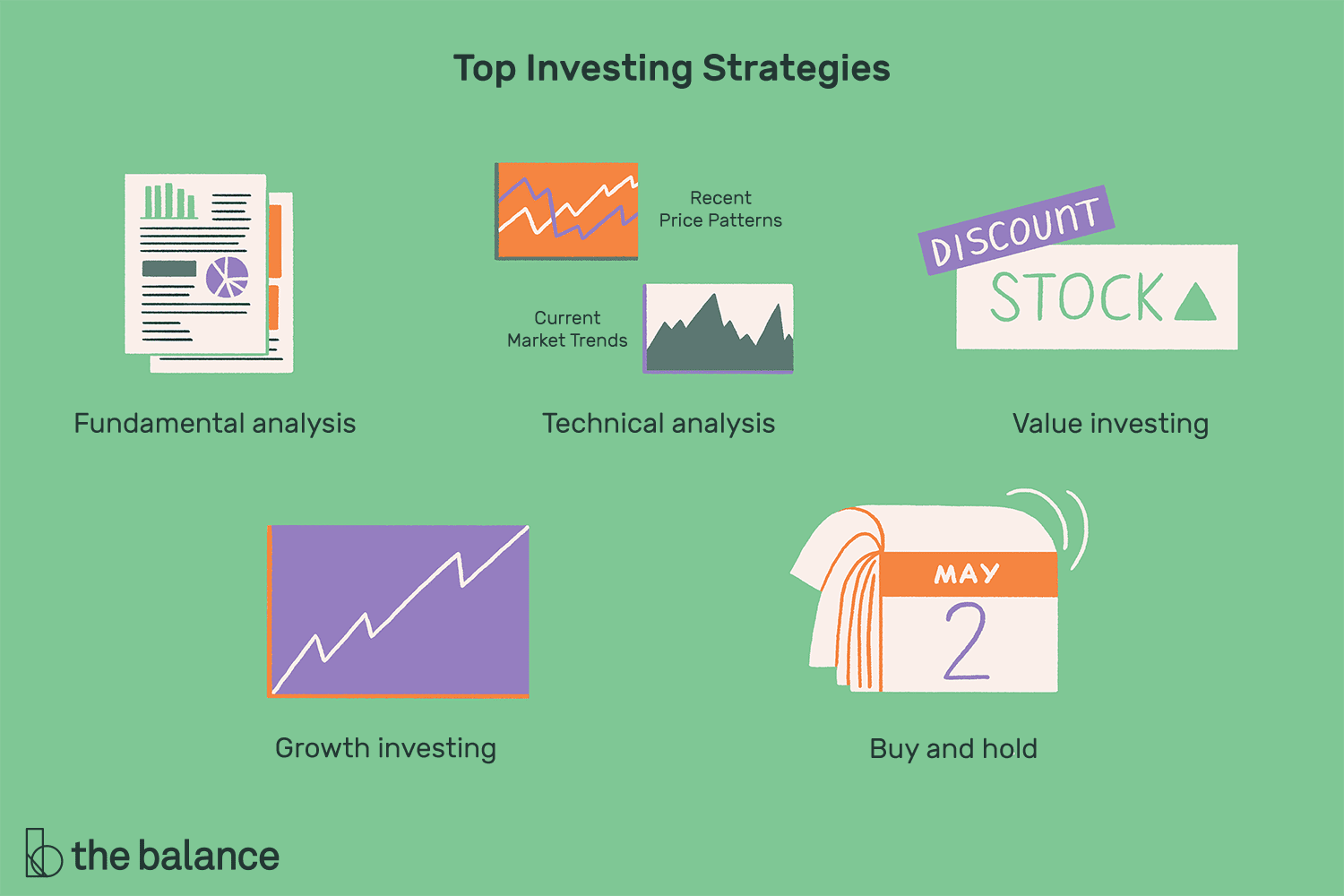

Choosing the Right Investment Strategy

Your investment strategy should align with your financial goals, risk tolerance, and investment horizon.

Risk Tolerance

Understand your risk tolerance – the degree of variability in investment returns that you can withstand. Generally, higher risk can lead to higher rewards, but also higher potential losses.

Diversification

Diversification involves spreading your investments across various asset classes (stocks, bonds, real estate) to reduce risk. A diversified portfolio can help balance the performance of different investments.

Types of Investments

Stocks

Stocks represent ownership in a company and entitle you to a portion of the profits. They offer high potential returns but come with higher risk.

Bonds

Bonds are loans made to corporations or governments in exchange for periodic interest payments. They are generally considered safer than stocks but offer lower returns.

Mutual Funds

Mutual funds pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers.

Real Estate

Investing in real estate involves purchasing property to generate rental income or capital appreciation. Real estate can provide steady income and potential tax benefits.

ETFs

Exchange-Traded Funds (ETFs) are similar to mutual funds but trade like stocks on an exchange. They offer diversification and typically have lower fees.

Opening an Investment Account

To start investing, you’ll need to open an investment account. Choose between a brokerage account or a retirement account (like an IRA).

Choosing a Brokerage

Select a brokerage firm that suits your needs. Consider factors like fees, investment options, research tools, and customer service.

Making Your First Investment

Once your account is set up, it’s time to make your first investment. Start with a small amount to get comfortable with the process.

Regular Contributions

Regular contributions to your investment account can help grow your portfolio over time. Consider setting up automatic transfers to stay consistent.

Monitoring and Adjusting Your Portfolio

Regularly review your portfolio to ensure it aligns with your goals. Make adjustments as needed based on changes in the market or your personal circumstances.

Rebalancing

Rebalancing involves adjusting your portfolio to maintain your desired asset allocation. This may involve selling some investments and buying others.

Staying Informed

Keep up-to-date with market trends, economic news, and financial reports. Staying informed can help you make better investment decisions.

Trusted Sources

Follow reputable financial news sources like Bloomberg, CNBC, and The Wall Street Journal.

Avoiding Common Mistakes

Emotional Investing

Avoid making investment decisions based on emotions. Stick to your strategy and avoid reacting impulsively to market fluctuations.

Overtrading

Excessive trading can lead to high fees and potential losses. Focus on long-term growth rather than short-term gains.

Ignoring Fees

Be aware of fees associated with your investments. High fees can erode your returns over time.

Seeking Professional Advice

Consider consulting a financial advisor, especially if you’re unsure about your investment strategy. A professional can provide personalized advice based on your financial situation.

Conclusion

Investing can be a powerful tool for building wealth and achieving financial security. By understanding the basics, setting clear goals, and following a disciplined approach, you can navigate the complexities of the market and set yourself up for success. Remember, the key to successful investing is patience, education, and consistency. Happy investing!